How Does Carbon Credit Exchange Work?

Carbon Credit Exchange Work

Buying and selling carbon credits involves a complex process. The price of a credit depends on its vintage, geography, and underlying project. The quantity of credits traded at a given time also affects the price. Companies, individuals, and communities can use or sell carbon credits.

Typically, industrial projects produce large volumes of credits. These credits can be used to offset pollution or to provide other social benefits. They can also be sold to other polluters or used to neutralize residual emissions.

The value of a carbon credit exchange depends on a number of factors, including the size of the underlying project, its geography, and the delivery period. A carbon project’s geographic location, such as a reforestation project, may result in a higher price than one that is located in a remote area. In addition, the number of credits issued each year will depend on the emission targets.

How Does Carbon Credit Exchange Work?

Traders and investors prefer carbon credit products that are standardized. Such products ensure that the basic characteristics of the underlying project are met, and the end buyer does not have to spend a great deal of time inspecting the underlying project. Non-standardized products, on the other hand, allow the end buyer to do a more detailed inspection of the underlying project.

While standardized products are preferred by traders and investors, many end buyers prefer to invest in credits that are not standardized. This allows them to inspect the underlying project and verify its authenticity. It also helps them to avoid accusations of greenwashing.

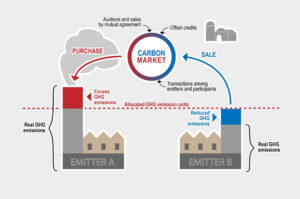

There are two primary types of exchanges: the regulated carbon market and the voluntary carbon market. The regulated market is governed by regulation and generally trades only in carbon allowances. The voluntary carbon market is not governed by regulations. Instead, the market allows for companies to work with environmentally conscious sellers of carbon offsets. Its participants may receive an initial allocation of credits free of charge, or they can purchase credits from the market.

The carbon credit market is estimated to reach $2.4 trillion by 2027. This is primarily due to the growing emphasis on reducing greenhouse gas emissions. This growth is expected to continue. It is also anticipated that the number of businesses that have adopted net-zero goals will increase. Traders, institutional investors, and brokers should consider investing in a carbon exchange.

In the future, an independent third-party organization should define an attribute taxonomy for carbon credits. This will help sellers and buyers to identify credits and find them easier. In addition, it could help lower the cost of issuance and enable companies to quickly make payments.

The carbon credit market is expected to grow at a 31% CAGR through 2027. This growth will be mainly driven by companies with ambitious goals to achieve net zero carbon emissions. It will also be used by multinational corporations and institutional investors. This market is characterized by low liquidity and inadequate risk-management services. It is also a highly-complex and heterogeneous marketplace, creating the potential for errors, fraud, and money laundering.